R&D Performance and Funding Sources

Between 2020 and 2021, U.S. R&D performance by the semiconductor manufacturing industry increased 9.8% in current U.S. dollars to $47.4 billion. This was after a 22.8% increase between 2019 and 2020 (table 1) (see also NSB 2024b). R&D by the semiconductor machinery manufacturing industry reached $5.3 billion in 2021, up 11.2% from 2020, compared with an increase of 7.8% between 2019 and 2020 (table 1). In 2021, the share of semiconductor manufacturing R&D within overall U.S. computer manufacturing R&D was 47%, whereas the share of semiconductor machinery R&D in overall machinery R&D was 30%. This R&D was conducted by an estimated 660 R&D-performing companies classified in the semiconductor manufacturing industry and 60 R&D-performing companies in the semiconductor machinery manufacturing industry.

U.S. R&D performed, by semiconductor manufacturing and other selected industries: 2017–21

NAICS = North American Industry Classification System.

Note(s):

Data are for companies with 10 or more domestic employees. Excludes data for federally funded research and development centers. Detail may not add to total because of rounding. Industry classification is based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Statistics are representative of companies located in the United States that performed or funded $50,000 or more of R&D. For survey years 2014–19, industry classification was based on the 2012 NAICS. For survey years beginning in 2020, classification was based on the 2017 NAICS. Most statistics for years prior to 2020 have been revised since original publication. Revised statistics include adjustments based on information obtained after the original statistics were prepared. An estimate range may be displayed in place of a single estimate to avoid disclosing operations of individual companies.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey.

The vast majority of domestic R&D performed by these two industries was funded by the performing company: 96% for semiconductor manufacturing, and 97% for semiconductor machinery manufacturing, compared with 88% for total manufacturing. The largest external funding source for both semiconductor-related industries was companies located outside the United States (4% and 3%, respectively), similar to the 5% share for total manufacturing (table 2).

U.S. business R&D performance, by source of funds and selected industry: 2021

i = more than 50% of the estimate or its components are a combination of imputation and reweighting to account for nonresponse.

NAICS = 2017 North American Industry Classification System.

a All R&D is the cost of R&D paid for and performed by the respondent company and paid for by others outside of the company and performed by the respondent company.

Note(s):

Data are for companies with 10 or more domestic employees. Detail may not add to total because of rounding. Industry classification was based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Excludes data for federally funded research and development centers.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

Geography of Semiconductor R&D

Of the $47.4 billion in U.S. R&D performance by the semiconductor manufacturing industry in 2021, $45.5 billion was company-funded R&D. Of that company-funded amount, $23.0 billion (51%) was performed in California (table 3). By comparison, the share of total manufacturing company-funded R&D performed in California was 32% in 2021. The large share of California in semiconductor manufacturing R&D is consistent with the historical role of semiconductor patenting associated with Silicon Valley’s Santa Clara, CA county (Robbins and Cosby 2023). Companies located in the next five states—Oregon, Arizona, Texas, Idaho, and Massachusetts—conducted a combined share of 38% of company-funded semiconductor manufacturing R&D (Moris and Rhodes 2024).

Domestic R&D paid for and performed by the company, distributed by selected industry and state: 2021

NAICS = 2017 North American Industry Classification System.

Note(s):

Percentages are for the top six states across industries. Detail may not add to total because of rounding. Industry classification is based on the dominant business code for domestic R&D performance, where available. Statistics are representative of companies located in the United States that performed or funded $50,000 or more of R&D

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

R&D performed by the U.S. semiconductor machinery manufacturing industry was more concentrated, with 65% performed in California, with the next three states—Oregon, Texas, and Massachusetts—accounting for another 28% (table 3). For related state-level value-added production by computer manufacturing and other knowledge- and technology-intensive (KTI) industries, see “Geography of Domestic KTI Production” in Science and Engineering Indicators 2024 (NSB 2024a).

Type of R&D and Technology Focus

R&D comprises basic research, applied research, and experimental development. In 2021, experimental development accounted for the largest share of domestic R&D performance by both the semiconductor manufacturing and semiconductor machinery manufacturing sectors (90% and 75%, respectively), consistent with the large share of experimental development in U.S. business R&D (Britt 2023). R&D can also be classified by the technology applications being pursued. Nanotechnology accounted for 9% of total manufacturing R&D performed in 2021 (table 4). However, within semiconductor manufacturing and semiconductor machinery manufacturing R&D, nanotechnology accounted for 50% and 43%, respectively. Nanotechnology R&D in the semiconductor and related microelectronics industry supports the development of technical standards, materials, and fabrication processes targeted at smaller and densely integrated components for semiconductor devices (NIST 2023b; NSTC 2024). Software products and embedded software and AI applications represented the next-largest technology focus areas for both semiconductor industries’ R&D performance, based on 2021 BERD statistics (table 4).

U.S. business R&D performed, by selected industry and technology focus: 2021

i = more than 50% of the estimate is a combination of imputation and reweighting to account for nonresponse.

NAICS = 2017 North American Industry Classification System.

Note(s):

Data are for companies with 10 or more domestic employees. Detail may not add to total because of rounding. Industry classification is based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Companies could report R&D in one, more than one, or no application area.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

Labor Costs in Semiconductor R&D

Labor costs comprise three major categories: salaries, wages, and fringe benefits; stock-based compensation; and temporary staffing costs. R&D labor costs accounted for 66% of U.S. private sector R&D performance ($31.1 billion of $47.4 billion) for semiconductor manufacturing and 58% ($3.1 billion of $5.3 billion) for semiconductor machinery manufacturing in 2021 (table 5). These shares are similar to the 63% of U.S. private sector performance for total manufacturing. In 2021, the largest component of U.S. private sector R&D labor costs in both semiconductor manufacturing and semiconductor machinery manufacturing was salaries, wages, and fringe benefits at 81% and 89%, respectively, similar to the 84% share in total manufacturing. Notably, the semiconductor manufacturing industry reported one of the highest percentages of labor costs from stock-based compensation among manufacturing industries at 16%, compared with 9% for total manufacturing.

Domestic R&D paid for by the company and others and performed by the company, by type of cost, and selected industry: 2021

NAICS = 2017 North American Industry Classification System.

Note(s):

Data are for companies with 10 or more domestic employees. Detail may not add to total because of rounding. Industry classification is based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Statistics are representative of companies located in the United States that performed or funded $50,000 or more of R&D.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

Semiconductor R&D Intensities Based on Sales and Employment

The U.S. semiconductor manufacturing and semiconductor machinery industries had two of the highest R&D-to-sales ratios, or intensities, in 2021 at 20% and 18%, respectively (table 6). This R&D intensity refers to the industries’ domestic R&D performance as a percentage of net sales. Among all manufacturing industries, this intensity was 5%.

Sales, R&D, R&D-to-sales ratio, employment, and R&D-to-employment ratio for companies that performed or funded business R&D in the United States, by selected industry: 2021

NAICS = North American Industry Classification System.

a Net sales are for goods sold or services rendered by R&D-performing or R&D-funding companies located in the United States to customers outside of the company, including the U.S. federal government, foreign customers, and the company's foreign subsidiaries. Included are revenues from a company's foreign operations and subsidiaries and from discontinued operations. If a respondent company is owned by a foreign parent company, sales to the parent company and to affiliates not owned by the respondent company are included. Excluded are intracompany transfers, returns, allowances, freight charges, and excise, sales, and other revenue-based taxes.

b All R&D is the cost of R&D paid for and performed by the respondent company and paid for by others outside of the company and performed by the respondent company.

c R&D-to-sales ratio is the cost of domestic R&D paid for by the respondent company and others outside of the company and performed by the company divided by domestic net sales of companies that performed or funded R&D.

d Data recorded on 12 March represent employment figures for the year.

e Headcounts of researchers, R&D managers, technicians, clerical staff, and others assigned to R&D groups.

f R&D-to-employment ratio is the headcount of R&D employees (researchers and R&D managers, technicians or equivalent staff, and other supporting staff) divided by the total number of employees.

Note(s):

Data are for companies with 10 or more domestic employees. Detail may not add to total because of rounding. Industry classification was based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

R&D employment and R&D employment intensity measures provide vital information on the human resources that directly contribute to R&D activities (OECD 2015). R&D employment intensity is calculated as the headcount of R&D employees (researchers and R&D managers, technicians or equivalent staff, and other supporting staff) as a percentage of total employees. The two semiconductor-related industries covered in this report have among the highest R&D employment intensities within U.S. manufacturing (table 7). In 2021, semiconductor manufacturing and semiconductor machinery manufacturing had R&D employment intensities of 34% and 35%, respectively. These were well above the R&D employment intensities reported by U.S. companies in 2021 for total manufacturing (10%) and all industries (9%).

Domestic employment, R&D employment by sex and work activity, R&D researchers by level of education, and full-time equivalent researcher employment for companies that performed or funded U.S. business R&D, by selected industry: 2021

* = amount < 500 employees; i = more than 50% of the estimate is a combination of imputation and reweighting to account for nonresponse.

NAICS = North American Industry Classification System.

a Data recorded on 12 March represent employment figures for the year.

b Researchers includes R&D scientists and engineers and their managers.

c Other supporting staff includes clerical staff and others assigned to R&D groups.

d The number of persons employed who were assigned full time to R&D, plus a prorated number of employees who worked on R&D only part of the time.

Note(s):

Data are for companies with 10 or more domestic employees. Detail may not add to total because of rounding. Industry classification was based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Excludes data for federally funded research and development centers.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

Employment Type and Demographics in Semiconductor R&D

Across all U.S. manufacturing industries, 67% of R&D employees were classified as researchers, 21% as technicians or equivalent staff, and 12% as supporting staff in 2021 (table 7 and figure 1). For the semiconductor manufacturing industry, the share of researchers was higher at 86% of R&D employees, and lower for the semiconductor machinery industry (57%).

R&D employment for companies that performed or funded U.S. business R&D, by selected manufacturing and semiconductor industry: 2021

| Industry | Researchers with PhD | Researchers without PhD | Technicians and equivalent staff | Other supporting staff |

|---|---|---|---|---|

| Manufacturing industries | 8 | 59 | 21 | 12 |

| Semiconductor and other electronic components | 10 | 76 | 11 | 4 |

| Semiconductor machinery | 14 | 43 | 43 | * |

Note(s):

Data are for companies with 10 or more domestic employees. Detail may not add to total due to rounding. Positive amounts that round to zero are not displayed. Industry classification was based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Excludes data for federally funded research and development centers. "Other supporting staff" includes clerical staff and others assigned to R&D groups.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

In 2021, the share of researchers with PhDs was 25% for semiconductor machinery manufacturing, compared with 11% in both semiconductor manufacturing and overall manufacturing (table 7 and figure 1). Lastly, the share of female R&D employment in semiconductor machinery manufacturing was 14% in 2021, consistent with the share in overall machinery manufacturing but lower than the 26% share in semiconductor manufacturing and 27% in total manufacturing (table 7).

Capital Expenditures for Semiconductor R&D

U.S. semiconductor manufacturing companies invested $5.0 billion in assets such as buildings, equipment, and software to support their domestic R&D activities in 2021, whereas semiconductor machinery companies invested $314 million. These capital expenditures are separate from the R&D expenditures described elsewhere in this report.

Assets used for R&D operations include land acquisitions, buildings and land improvement, machinery and equipment, capitalized software, and other assets (which includes other intellectual property). The largest share of expenditures, by far, for the U.S. semiconductor-related industries featured here was for machinery and equipment (64% for semiconductor manufacturing and 87% for semiconductor machinery manufacturing) (figure 2). The corresponding share for all industries and for total manufacturing was 37% and 53%, respectively.

Business capital expenditures in support of domestic R&D, by type and selected industry: 2021

| Industry | Machinery and equipment | Capitalized software | Buildings and land | All other |

|---|---|---|---|---|

| All industries | 37 | 31 | 11 | 21 |

| Manufacturing industries | 53 | 9 | 14 | 23 |

| Machinery | 60 | 11 | 9 | 19 |

| Semiconductor machinery | 87 | 4 | 1 | 9 |

| Computer and electronic products | 56 | 11 | 10 | 23 |

| Semiconductor and other electronic components | 64 | 15 | 6 | 15 |

| Nonmanufacturing industries | 18 | 56 | 7 | 19 |

Note(s):

Data are for companies with 10 or more domestic employees. Industry classification is based on the dominant business code for domestic R&D performance, where available. For companies that did not report business codes, the classification used for sampling was assigned. Statistics are representative of companies located in the United States that performed or funded $50,000 or more of R&D.

Source(s):

National Center for Science and Engineering Statistics and Census Bureau, Business Enterprise Research and Development Survey, 2021.

Data Sources, Scope, and Limitations

The sample for the BERD Survey was selected to represent all for-profit, nonfarm companies that were publicly or privately held, had 10 or more employees in the United States, and performed or funded R&D either domestically or abroad. Beginning in survey year 2018, companies that performed or funded less than $50,000 of R&D were excluded. The estimates in this InfoBrief are based on responses from a sample of the population and may differ from actual values because of sampling variability or other factors. As a result, apparent differences between the estimates for two or more groups may not be statistically significant. All comparative statements in this InfoBrief have undergone statistical testing and are significant at the 90% confidence level unless otherwise noted. Because the statistics from the survey are based on a sample, they are subject to both sampling and nonsampling errors. (For “Technical Notes” and other methodology information, see https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#methodology.)

In this InfoBrief, money amounts are expressed in current U.S. dollars and are not adjusted for inflation. A company is defined as a business organization located in the United States, either U.S.-owned or a U.S. affiliate of a foreign parent company, of one or more establishments under common ownership or control. Industry classification is based on the dominant business code for domestic R&D performance. For companies that did not report business codes, the industry classification used for sampling was assigned using administrative payroll data. BERD Survey data excludes federally funded research and development centers. General survey information including survey questionnaires and all available data can be found at https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021.

BERD Survey statistics for 2020 and 2021 are based on the 2017 North American Industry Classification System (NAICS). The semiconductor and other electronic component manufacturing industry (NAICS 3344) produces semiconductor devices such as transistors and integrated circuits. Other electronic components include bare printed circuit boards, capacitors, resistors, and electronic connectors. The semiconductor machinery manufacturing industry (NAICS 333242) products include wafer processing and etching equipment, and semiconductor assembly and packaging equipment.

Lastly, industries covered in this report may devote some of their R&D expenditures to areas outside of semiconductors materials, processes, or products. At the same time, other industries not covered here may also engage in semiconductors and related microelectronics R&D, such as other segments of computer and electronic product manufacturing (NAICS 334), as well as software publishers (NAICS 5112) and scientific R&D services (NAICS 5417).

NCSES has reviewed this product for unauthorized disclosure of confidential information and approved its release (NCSES-DRN24-070).

References

15 U.S. Code (USC) §4656 Advanced Microelectronics Research and Development. Available at https://uscode.house.gov/view.xhtml?req=(title:15%20section:4656%20edition:prelim). Accessed 4 May 2024.

Anderson G, Shackelford B; National Center for Science and Engineering Statistics (NCSES). 2023. Women Made Up Over a Quarter of All Business R&D Employees in 2020. NSF 23-328. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf23328/.

ASML. 2024. Microchip Basics. Available at https://www.asml.com/en/technology/all-about-microchips/microchip-basics. Accessed 31 May 2024.

Boston Consulting Group (BCG), Semiconductor Industry Association (SIA). 2021. Strengthening the Global Semiconductor Supply Chain in an Uncertain Era. Available at https://www.semiconductors.org/strengthening-the-global-semiconductor-supply-chain-in-an-uncertain-era.

Bresnahan TF, Trajtenberg M. 1995. General Purpose Technologies “Engines of growth”? Journal of Econometrics 65(1):83–108. Available at https://doi.org/10.1016/0304-4076(94)01598-T.

Britt R; National Center for Science and Engineering Statistics (NCSES). 2023. Business R&D Performance in the United States Tops $600 Billion in 2021. NSF 23-350. Alexandria, VA: U.S. National Science Foundation. Available at http://ncses.nsf.gov/pubs/nsf23350.

Congressional Research Service (CRS). 2016. U.S. Semiconductor Manufacturing: Industry Trends, Global Competition. Available at https://crsreports.congress.gov/product/details?prodcode=R44544.

Congressional Research Service (CRS). 2023a. Semiconductors and the CHIPS Act: The Global Context. Available at https://crsreports.congress.gov/product/pdf/R/R47558.

Congressional Research Service (CRS). 2023b. Semiconductors and the Semiconductor Industry. Available at https://crsreports.congress.gov/product/pdf/r/r47508.

Defense Advanced Research Projects Agency (DARPA). 2023. Next-Generation Microelectronics Manufacturing Program. Available at https://www.darpa.mil/news-events/2023-11-17. Accessed 5 May 2024.

Goldberg PK, Juhász R, Lane NJ, Forte GL, Thurk J. 2024. Industrial Policy in the Global Semiconductor Sector. National Bureau of Economic Research (NBER) Working Paper No. 32651. Available at https://www.nber.org/papers/w32651.

Jorgenson DW. 2001. Information Technology and the U.S. Economy. American Economic Review 91:1–32. Available at https://doi.org/10.1257/aer.91.1.1.

Khan SM, Mann A, Peterson D. 2021. The Semiconductor Supply Chain: Assessing National Competitiveness. Center for Security and Emerging Technology (CSET), Georgetown University, Washington DC. Available at https://doi.org/10.51593/20190016. Accessed 4 May 2024.

Kuan J, West J. 2023. Interfaces, Modularity and Ecosystem Emergence: How DARPA Modularized the Semiconductor Ecosystem. Research Policy 52(8):104789. Available at https://doi.org/10.1016/j.respol.2023.104789.

Moris F; National Center for Science and Engineering Statistics (NCSES). 2021. Foreign R&D Reported by IT-Related Industries Account for About Half or More of U.S.-Owned R&D Performed in India, China, Canada, and Israel. NSF 22-328. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf22328/.

Moris F, Pece C; National Center for Science and Engineering Statistics (NCSES). 2022. Definitions of Research and Development: An Annotated Compilation of Official Sources. NCSES 22-209. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/ncses22209.

Moris F, Rhodes A; National Center for Science and Engineering Statistics (NCSES). 2024. Six States Perform around 90% of Semiconductor Business R&D, Led by California. NSF 24-329. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf24329.

Moris F, Shackelford B; National Center for Science and Engineering Statistics (NCSES). 2023. Businesses Invested $32.5 Billion in Assets to Support Their R&D Activities in the United States in 2020. NSF 23-327. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf23327.

National Institute of Standards and Technology (NIST). 2023a. CHIPS for America’s R&D Programs. Available at https://www.nist.gov/chips/research-development-programs. Accessed 7 November 2023.

National Institute of Standards and Technology (NIST). 2023b. Metrology Gaps in the Semiconductor Ecosystem. Available at https://www.nist.gov/system/files/documents/2023/06/05/CHIPS_Metrology-Gaps-in-the-Semi-Ecosystem_0.pdf.

National Science Board (NSB), U.S. National Science Foundation (NSF). 2024a. Production and Trade of Knowledge- and Technology-Intensive Industries. Science and Engineering Indicators 2024. NSB-2024-7. Alexandria, VA. Available at https://ncses.nsf.gov/pubs/nsb20247.

National Science Board (NSB), U.S. National Science Foundation (NSF). 2024b. Research and Development: U.S. Trends and International Comparisons. Science and Engineering Indicators 2024. NSB-2024-6. Alexandria, VA. Available at https://ncses.nsf.gov/pubs/nsb20246/.

U.S. National Science Foundation (NSF). 2024. Semiconductors and Microelectronics. Available at https://new.nsf.gov/focus-areas/semiconductors. Accessed 4 May 2024.

National Science and Technology Council (NSTC), Office of Science and Technology Policy (OSTP). 2024. National Strategy on Microelectronics Research. Available at https://www.whitehouse.gov/ostp/news-updates/2024/03/15/nstc-national-strategy-on-microelectronics-research/.

Organisation for Economic Cooperation and Development (OECD). 2015. Frascati Manual 2015: Guidelines for Collecting and Reporting Data on Research and Experimental Development, 7th ed. Paris: OECD Publishing.

Organisation for Economic Cooperation and Development (OECD). 2019. Measuring Distortions in International Markets: The Semiconductor Value Chain. OECD Trade Policy Papers, No. 234. Paris: OECD Publishing. Available at https://www.oecd-ilibrary.org/trade/measuring-distortions-in-international-markets_8fe4491d-en.

Organisation for Economic Cooperation and Development (OECD). 2023. Vulnerabilities in the Semiconductor Supply Chain. OECD Science, Technology and Industry Working Paper. Paris: OECD Publishing. Available at https://doi.org/10.1787/6bed616f-en.

Robbins C, Cosby B; National Center for Science and Engineering Statistics (NCSES). 2023. One-Fifth of USPTO Semiconductor Utility Patents Granted to Residents of Santa Clara County, California between 2000 and 2020. NSF 23-342. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf23342/.

Semiconductor Industry Association (SIA). 2022. American Semiconductor Research: Leadership Through Innovation. Available at https://www.semiconductors.org/american-semiconductor-research-leadership-through-innovation/.

Semiconductor Industry Association (SIA), Nathan Associates. 2016. Beyond Borders: The Global Semiconductor Value Chain: How an Interconnected Industry Promotes Innovation and Growth. Available at https://www.semiconductors.org/wp-content/uploads/2018/06/SIA-Beyond-Borders-Report-FINAL-June-7.pdf.

Thadani A, Allen GC. 2023. Mapping the Semiconductor Supply Chain: The Critical Role of the Indo-Pacific Region. Washington DC: Center for Strategic and International Studies (CSIS). Available at https://www.csis.org/analysis/mapping-semiconductor-supply-chain-critical-role-indo-pacific-region.

Notes

1Chips are small electronic devices consisting of microelectronic circuits etched on wafers (flat substrate) of silicon or other semiconductor materials and include integrated circuits and discrete chips. They can be classified as logic and processing chips (e.g., central processing units [CPUs] and graphics processing units [GPUs]); memory chips (e.g., dynamic random access memory [DRAM] and flash memory chips); analog chips; and discrete transistors optoelectronics, and sensors (ASML 2024; BCG and SIA 2021; SIA 2022).

2CHIPS = Creating Helpful Incentives to Produce Semiconductors.

3For state-level incentives, see summary table in https://taxfoundation.org/blog/state-semiconductor-incentives/. For semiconductor policies globally, see Goldberg et al. (2024), OECD (2019), and Thadani and Allen (CSIS) (2023).

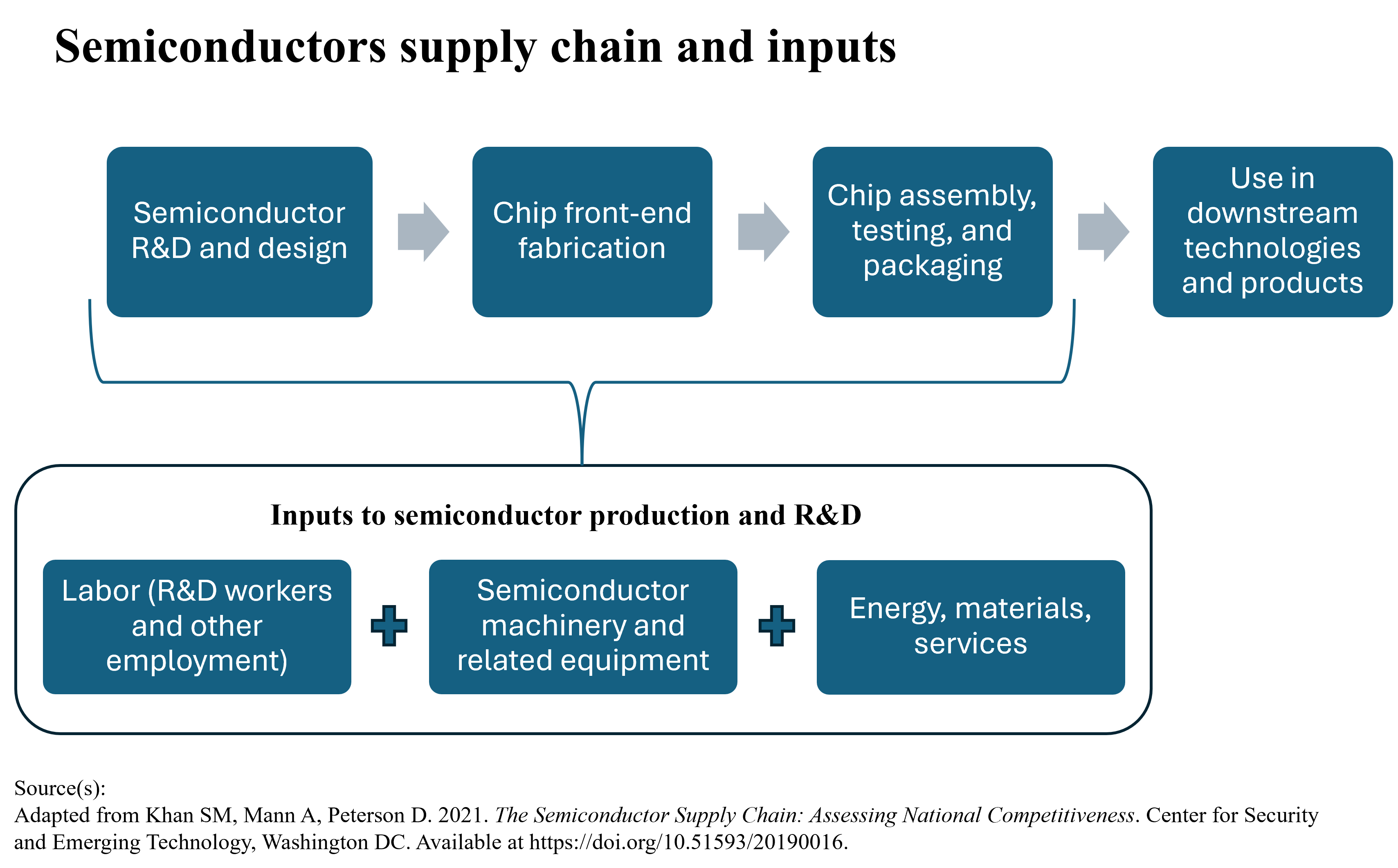

4The simplified supply chain figure abstracts from a complex, globally distributed, semiconductor industry structure that has been described along two major business models involving outsourcing (contract manufacturing and intellectual property licensing), international trade, or foreign direct investment (Kuan and West 2023; SIA and Nathan Associates 2016; Thadani and Allen [CSIS] 2023). The “fabless-foundry” model involves R&D or design-only firms (often called fabless companies), many owned by or located in the United States or Europe (BCG and SIA 2021), with outsourced production to domestic or foreign contract manufacturers or dedicated fabrication firms (chip foundries or fabs) and specialized chip testing and packing companies in Mainland China, other Asia, and elsewhere. Other companies follow a model where both chip design and fabrication are done in house. These companies, known as integrated device manufacturers (IDMs) are often multinational companies. Lastly, chip and chip-making equipment companies interact with each other and with their software and materials suppliers in technology alliances, industry consortia, and other forms of collaborative innovation facilitating international knowledge flows and “learning by doing” in manufacturing processes (Goldberg et al. 2024; Thadani and Allen [CSIS] 2023).

5See also Thadani and Allen (CSIS) (2023).

6For foreign R&D in information and communication technology (ICT)-related industries, see Moris (2021).

7Semiconductor manufacturing R&D accounted for 8% of the $602.5 billion in total U.S. business R&D performance in 2021 (table 1), whereas semiconductor machinery R&D accounted for another 1%.

8Separately, 181 companies with 1–9 domestic employees classified in the semiconductor and other electronic components manufacturing industry (NAICS 3344) performed $71.2 million of R&D in the United States in 2021, based on the Annual Business Survey (ABS). (Data for the semiconductor machinery manufacturing industry are included in ABS totals but are not separately available.) These companies will not be covered in this report. For additional information on the ABS, see https://ncses.nsf.gov/surveys/annual-business-survey/2022.

9Overall, there was an estimated 31,490 U.S. R&D performing companies with 10 or more domestic employees in 2021. See 2021 BERD Survey: table 4 at https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#data. See also technical table A-2 at https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#technical-tables. The BERD Survey is designed primarily to produce valid estimates of money amounts related to the performance and funding of R&D. Because this is the survey’s focus, estimation of meaningful company counts is difficult. For additional methodology information see “Company Counts” at https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#methodology.

10For information on the BERD methodology for allocating R&D performance by state, see “R&D, by Core-Based Statistical Area or State” at https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#methodology.

11See Moris and Pece (2022) for definitions and related information on type of R&D.

12See 2021 BERD Survey: table 12 in https://ncses.nsf.gov/surveys/business-enterprise-research-development/2021#data.

13For related information, see “U.S. Business R&D in Selected Critical and Emerging Technologies” in Science and Engineering Indicators 2024 (NSB 2024b).

14All other costs include materials and supplies; depreciation and amortization on R&D property, plant, equipment, and intangible assets; royalties and licensing fees; expensed equipment (not capitalized); and non-R&D services.

15Table 7 also shows the subset of headcount employment that was estimated to be full-time equivalent (FTE). FTE R&D employees are workers devoted full time to R&D, plus a prorated number of employees who worked on R&D only part of the time.

16For related information on female R&D employment and S&E degrees awarded to women, see Anderson and Shackelford (2023).

17Capital expenditures for R&D are a subset of total capital expenditures. Companies that perform or fund R&D classified in the semiconductor industry reported an estimated $32.0 billion of total domestic capital expenditures, based on 2021 BERD Survey statistics. Thus, $5.0 billion of capital expenditures for domestic R&D noted above accounted for 16% of these assets. The corresponding share for semiconductor machinery manufacturing companies was also 16% in 2021: $1.9 billion in total domestic capital expenditures of which $314 million was devoted to R&D. See Moris and Shackelford (2023) for an overview and more information on domestic R&D capital expenditures.

18Other intellectual property products include purchased patents, long-term licenses, or other intangible assets that are used in R&D operations, and which have a useful life of more than 1 year.

19For more details on the composition of these NAICS industries, see https://www.census.gov/naics/.

Suggested Citation

Moris F and Rhodes A; National Center for Science and Engineering Statistics (NCSES). 2024. U.S. Business R&D in Semiconductor-Related Industries. NSF 25-304. Alexandria, VA: U.S. National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf25304.

Contact Us

NCSES

National Center for Science and Engineering Statistics

Directorate for Social, Behavioral and Economic Sciences

U.S. National Science Foundation

2415 Eisenhower Avenue, Suite W14200

Alexandria, VA 22314

Tel: (703) 292-8780

FIRS: (800) 877-8339

TDD: (800) 281-8749

E-mail: ncsesweb@nsf.gov

NSF 25-304

|November 20, 2024

An official website of the United States government

An official website of the United States government