Annual Business Survey: Tables for Data Year 2017

General Notes

The Annual Business Survey (ABS) is the primary source of information on domestic research and development expenditures and the R&D workforce for companies with one to nine employees operating in the 50 U.S. states and the District of Columbia. The survey is conducted by the U.S. Census Bureau in accordance with an interagency agreement with the National Center for Science and Engineering Statistics (NCSES) within the National Science Foundation. In addition to R&D, the ABS collects data on innovation, technology, intellectual property, and business owner characteristics. The first year of data collection for the ABS is 2017.

The statistical tables included in this report supplement analytical InfoBriefs from NCSES, available at https://ncses.nsf.gov/pubs/nsf21302/.

The target population for the ABS consists of companies with at least one establishment physically located in the United States that are in business during the survey year and data collection period and have receipts of $1,000 or more.

The ABS includes questions from multiple reference periods. For the first cycle of the ABS the title of the survey used the reference year (2017). However, subsequent cycles of the ABS will use the collection year rather than reference year in the survey title. So the second cycle of the ABS will be referred to as the 2019 ABS and will include data for the reference year 2018.

The 2017 ABS sampling universe was constructed from the final 2016 Business Register. The Business Register is the Census Bureau’s comprehensive database of U.S. business establishments and companies, and combines data from business tax returns with data collected in the Economic Census and other Census Bureau surveys. The 2016 Business Register includes sole proprietorships, partnerships, and corporations reporting business activity to the Internal Revenue Service (IRS).

Data Tables

Survey aggregate estimates: 2017

| Table | View | Excel | |

|---|---|---|---|

| 1 | View Table 1 | Download Table 1 XLSX | Download Table 1 PDF |

Total R&D cost, by industry, employment size, sex, and race and ethnicity: 2017

Total R&D paid to others: 2017

Total sales and R&D: 2017

| Table | View | Excel | |

|---|---|---|---|

| 10 | View Table 10 | Download Table 10 XLSX | Download Table 10 PDF |

Total R&D cost, by state: 2017

| Table | View | Excel | |

|---|---|---|---|

| 11 | View Table 11 | Download Table 11 XLSX | Download Table 11 PDF |

| 12 | View Table 12 | Download Table 12 XLSX | Download Table 12 PDF |

R&D employees: 2017

R&D tax credit: 2017

Product innovation: 2015–17

Process innovation: 2015–17

Marketing innovation: 2015–17

Organizational innovation: 2015–17

Product or process innovation: 2015–17

Marketing or organizational innovation: 2015–17

All innovation: 2015–17

Product innovation and R&D activity: 2015–17

Process innovation and R&D activity: 2015–17

Product or process innovation and R&D activity: 2015–17

Innovation and factors that interfere with innovation: 2015–17

Innovation and regulations: 2015–17

Innovation and partnerships: 2015–17

Incomplete but ongoing innovation: 2015–17

New-to-market or new-to-business product innovation: 2015–17

Innovation and public support: 2015–17

Intellectual property: 2017

Importance of intellectual property: 2017

Technology: 2017

Technical Notes

Survey Overview

Purpose. The Annual Business Survey (ABS) provides information on selected economic and demographic characteristics for businesses and business owners by sex, ethnicity, race, and veteran status. Further, the survey measures research and development (R&D) (for microbusinesses), business topics such as innovation and technology, and other business characteristics. The ABS is conducted jointly by the U.S. Census Bureau and the National Center for Science and Engineering Statistics (NCSES) within the National Science Foundation (NSF). The ABS replaces the quinquennial Survey of Business Owners (SBO) for employer businesses, the Annual Survey of Entrepreneurs (ASE), the Business R&D and Innovation for Microbusinesses survey (BRDI-M), and the Innovation section of the Business R&D and Innovation Survey (BRDIS).

The ABS is designed to incorporate new content each survey year based on topics of relevance. For the 2017 ABS, content includes R&D, innovation, technology, and financing. R&D data are collected on the ABS for businesses with a W-2 employment range between one and nine employees.

Data collection authority. This collection is authorized under Title 13, United States Code, Sections 8(b), 131, and 182; Title 42, United States Code, Section 1861-76 (National Science Foundation Act of 1950, as amended); and Section 505 within the America COMPETES Reauthorization Act of 2010. Sections 224 and 225 of Title 13 require mandatory response. The Office of Management and Budget (OMB) control number is 0607-1004, expiration date 31 March 2021.

Survey sponsor. The ABS is sponsored by NCSES within NSF.

Survey collection and tabulation agent. The survey is conducted annually by the U.S. Census Bureau in accordance with an interagency agreement with NCSES within NSF.

Key Survey Information

Frequency. Annual.

Initial survey year. 2018.

Reference period. Calendar year 2017; for the innovation module, the reference period is 2015 to 2017.

Response unit. Firm.

Sample or census. Sample.

Population size. 5.3 million employer firms; 4.6 million employer firms were in scope for the innovation and technology modules; 3.5 million employer firms with between one and nine employees were in scope for the R&D module.

Sample size. 849,970 employer businesses.

Survey Design

Target Population

Included in the survey are all nonfarm businesses filing Internal Revenue Service (IRS) tax forms as individual proprietorships, partnerships, or any type of corporation, and with receipts of $1,000 or more. The ABS covers firms with paid employees only. The ABS is conducted on a company or firm basis rather than an establishment basis.

Sampling Frame

The sampling universe was constructed from the final 2016 Business Register. The Business Register is the Census Bureau’s comprehensive database of U.S. businesses. Business Register data are compiled from a combination of business tax returns, data collected from the economic census, and data from other Census Bureau surveys. The 2016 Business Register includes sole proprietorships, partnerships, and corporations reporting business activity to the IRS on any one of the following 2016 IRS tax forms: 1040 (Schedule C), “Profit or Loss from Business (Sole Proprietorship)”; 1065, “U.S. Return of Partnership Income”; 941, “Employer’s Quarterly Federal Tax Return”; 944, “Employer’s Annual Federal Tax Return”; or any one of the 1120 corporate tax forms.

The Business Register contains establishments that are out of scope for the ABS sample. These establishments are removed from the sampling universe. They include the following:

- Establishments engaged in the following North American Industry Classification System (NAICS) industries:

- 110000, 111, or 112 - Agriculture production

- 482 - Railroads

- 491 - Postal service

- 521 - Monetary authorities - Central bank

- 525 - Funds, trusts, and other financial vehicles

- 813 - Religious grant operations and religious organizations

- 814 - Private households

- 92 - Public administration

- Unclassified with legal form of organization as tax-exempt or unknown

- Establishments located in American Samoa, the Northern Mariana Islands, Guam, Puerto Rico, or the Virgin Islands

- Establishments belonging to foreign entities

- Government establishments

- Establishments with zero payroll and zero employment

- Establishments identified as out of business during prior year data review

- Single-unit establishments modeled as likely to be out of business using administrative data from the most recent monthly business register data sets.

Information on industry classification, receipts, payroll, and employment were extracted from the Business Register during the frame construction.

The sample is also designed to estimate demographic characteristics of the business owners. To efficiently sample for demographic characteristics, a variety of sources of information are used to estimate the likelihood that a business is woman or minority owned. Administrative sources include the Decennial Census, the American Community Survey (ACS), and the Numident file, which is the Social Security Administration’s comprehensive database of information from Social Security applications. Individual business owners were identified through IRS K-1 filings for partnerships and corporations and from the Business Register for sole proprietorships. The owners were matched to the 2000 and 2010 decennial censuses to get race, sex, and ethnicity data from the 2000–16 ACS and the Numident (in that order) through a Protected Identification Key. Country of birth is also identified through the linkages to the ACS or Numident data. Each firm is then placed in one of the following nine frames for sampling: American Indian or Alaska Native, Asian, Black or African American, Hispanic, Not Hispanic or Latino White Men, Native Hawaiian and Other Pacific Islander, Other, Publicly Owned, and Women. Businesses are assigned to one (and only one) frame, with priority given to the less common frames.

Sample Design

The ABS frame is stratified by geographic area defined by state, frame, and industry and is systematically sampled within each stratum. A standard type of estimation for stratified systematic sampling is used. Large companies were selected with certainty based on volume of sales, payroll, or number of paid employees. Certainty cases have a selection probability of 1 and a sampling weight of 1 and represent only themselves. Specifically for the 2017 ABS, firms were selected with certainty based on the following criteria: firms with more than 500 employees, firms classified in industry 5417, and firms larger than stratum-specific payroll and receipt cutoffs. The certainty cutoffs vary by sampling stratum, and each stratum is sampled at varying rates, depending on the number and size of firms in a particular stratum.

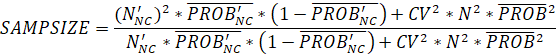

The remaining frame is subjected to stratified systematic random sampling. Sampling rates vary by strata and are determined by the following calculations. Note that a systematic sample uses take rate to sample where the sampling rate is 1 divided by the take rate.

where

|

|

= |

Number of companies in the stratum |

|

|

= |

Number of noncertainty companies in the stratum |

|

|

= |

Mean likelihood (PROB) of all companies in the stratum (PROB is the estimated probability or likelihood of a given sampling unit belonging to the frame to which it is assigned) |

|

|

= |

Mean likelihood of noncertainty companies in the stratum |

|

|

= |

Coefficient of variation |

The calculated sample size is rounded to the nearest integer. The minimum sample size for a stratum is 5 or the number of noncertainty cases in the stratum if the stratum has fewer than 5 noncertainty cases.

The coefficient of variation (CV) is initially set to 0.14, then adjusted to achieve the desired sample size. The final CV values were 0.22 for cases in the minority/female frames and 0.1788 for cases in the public/non-Hispanic white men frames.

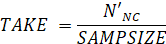

From the sample size, the take rate for each stratum is calculated as follows:

where

|

|

= |

Number of noncertainty companies in the stratum |

For strata where the take rate was greater than the maximum take rate, the take rate was set to the maximum take rate to ensure adequate sample size in each stratum. The maximum take rate was 10.

Each firm selected for the sample was asked the percentage of ownership, sex, ethnicity, race, and veteran status for up to four people owning the largest percentages of the business. These firms were then asked additional characteristic questions (e.g., age, education level). Additionally, all firms were asked to provide information on the business’s innovations and innovation activities and technology (patents, intellectual property, digital share of business activity, cloud service purchases, business technologies). Firms with between one and nine employees from the Business Register were asked to provide information regarding their R&D expenses.

The ABS sample consisted of 849,970 businesses. There were 177,548 selected with certainty. The certainty portion of the sample consisted of the following:

- 16,163 with employment greater than or equal to 500

- 11,855 in industry 5417

- 114,436 with payroll above the stratum cutoff

- 35,094 with receipts above the stratum cutoff (Note that payroll cutoffs are applied first, so cases above both cutoffs appear in the payroll count.)

The remaining 672,422 noncertainty cases were selected using systematic stratified random sample selection. The maximum sample weight was 10.

Data Collection and Processing Methods

Data collection. Prior to mailing the survey, certain businesses selected were determined to be out of scope and were not contacted. The survey was mailed to 849,782 employer businesses in June 2018. Businesses were sent a letter informing them of their requirement to report. The letter also provided instructions on how to access and submit the survey online. Two mail follow-up letters were sent to nonrespondents to boost the response rate. Additionally, the Census Bureau conducted an e-mail follow-up with select businesses. The data collection period closed in December 2018.

Mode. The 2017 ABS was collected using an electronic instrument only.

Unit Response Rates

Check-in rate. The check-in rate is defined as the unweighted number of surveys that were submitted online by in-scope companies, divided by the unweighted total number of all in-scope companies in the sample. Response to individual questions did not factor into this metric. At the close of the data collection period in December 2018, there were 559,833 responses submitted online, 65.9% of the sample.

An additional 7,619 businesses contacted the Census Bureau to indicate that the business was no longer in operation for the reference year via the call center.

Businesses selected to report R&D represented 68.3% of those that were mailed the survey. Of the businesses mailed the survey and selected to report R&D, 379,894 businesses, or 65.5%, submitted responses.

Unit response rate (URR). The URR is the unweighted number of responding companies for the survey. For the ABS, response is defined as a company providing the number of owners, number of paid owners, and number of employees, or a company responding that it ceased operations prior to 2017.

For the ABS, the URR was 67.8%. The URR for businesses eligible to report the R&D module was 67.6%.

Item Response Rates

The ABS collects data on approximately 670 variables, and the distribution of values reported by sample companies is highly skewed. Thus, rather than report unweighted item response rates, total quantity response rates are calculated, which are based on weighted data. The survey skip patterns vary for respondents; therefore, it can be impossible to know an exact denominator for item response calculations.

Total quantity response rate (TQRR). For a given published estimate other than count or ratio estimates, TQRR is the percentage of the weighted estimate based on data that were reported by units in the sample or on data that were obtained from other sources and were determined to be equivalent in quality to reported data and weighted only by sampling but not nonresponse weights. The TQRR for total sales in the United States in 2017 was 65.4%.

Total quantity nonresponse rate (TQNR). For a given published estimate, TQNR, defined as 100% minus TQRR, is calculated for each tabulation cell from the ABS, except for cells that contain count or ratio estimates. TQNR measures the combined effect of the procedures used to handle unit and item nonresponse on the weighted ABS estimate. Detailed imputation rates are available upon request.

Data Editing

Prior to tabulating the data, response data were reviewed and edited to correct reporting errors. During data analysis, it was determined that R&D data should be tabulated only for records reporting $50,000 or more in R&D expenditures, resulting in approximately 8,000 fewer cases to review. Had these cases been included in ABS estimates, they would have contributed approximately $200 million in R&D expenditures and approximately 18,000 to the weighted count of R&D companies, assuming they had similar reporting patterns as the companies that were reviewed.

Additionally, data were tabbed only for records classified in the following NAICS industries:

- 31–33 - Manufacturing

- 42 - Wholesale trade

- 51 - Information

- 5413 - Architectural, engineering, and related services

- 5415 - Computer systems design and related services

- 5417 - Scientific research and development services

Survey analysts reviewed the R&D reported by the survey respondents. Research was done by evaluating the reported business descriptions, reported R&D-to-sales ratio, and company website information. The majority of corrections involved false-positive reports or data reported using incorrect units (such as dollars instead of thousands of dollars). For NAICS industries 5415 and 5417, it is difficult to differentiate R&D from other technical work based solely on company website information. Because of this difficulty and the large number of companies sampled in these industries, it was not feasible to review each case individually, and relatively few corrections were made for false-positive reports.

Additional data errors were detected and corrected through mass corrections and an automated data edit system designed to review the data for reasonableness and consistency. The editing process interactively performed corrections by using standard procedures to fix detectable errors. Quality control techniques were used to verify that operating procedures were carried out as specified.

Techniques for Handling Unit and Item Nonresponse

For various reasons, many firms chose to return the survey questionnaire with one or more blank items. For some firms, internal accounting systems and procedures may not have allowed quantification of specific expenditures. Others may have refused to answer any questions as a matter of company policy. Weighted estimates produced from the ABS include adjustments to account for companies that did not respond to the survey (unit nonresponse) and for companies that did respond but left some questions blank (item nonresponse).

Unit Nonresponse

Unit nonresponse is handled by adjusting weighted reported data and imputed data as follows. Each company’s sampling weight is multiplied by a nonresponse adjustment factor. To calculate the adjustment factors, each company in the sample that is eligible for tabulation is assigned to one (and only one) adjustment cell. The adjustment cells are based on company size and NAICS sector. For company size, there are 5 categories: 1 to 4 employees, 5 to 9 employees, 10 to 49 employees, 50 to 249 employees, and 250 or more employees. For a given adjustment cell, the nonresponse adjustment factor is the ratio of the sum of the sampling weights for all companies in the cell to the sum of the sampling weights for all companies in the cell with reported or imputed data. For the nonresponse adjustment, a business is considered a respondent if it responded to the survey’s R&D module, innovation module, or technology module.

Item Nonresponse

Item nonresponse for a given company is handled by item imputation. Data are imputed using administrative data where available. If no administrative data are available, data are imputed by logical imputation or donor imputation depending on the particular item.

- Administrative data were substituted for missing values of employment and sales.

- If available, historical data from related programs (2016 ASE, 2015 ASE, 2014 ASE, or 2012 SBO) were substituted for missing data to determine the sex, ethnicity, race, and veteran status of the business owner or majority business owners. When historical data were not available, the sex, ethnicity, race, and veteran status were imputed from donor respondents in the same sampling frame with similar characteristics (industry, legal form of organization, geography).

- For categorical data items, logical imputation was used and missing data items were set to the most common response option (generally “No” or “N/A”).

- All other missing data items were imputed from donor respondents in the same imputation cell. Imputation cells were defined by sector, R&D activity, company size, legal form of organization, and state.

- Detailed tables of imputation rates corresponding to each data table are available from the NCSES project officer.

Weighting

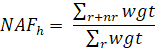

The survey data are weighted for sampling as designed for the ABS. The weights were adjusted for complete nonresponse as detailed in the following formula:

For adjustment cell h,

where

|

r |

= |

Partial and complete respondents (RESP in (“CR”, “PR”)) |

|

nr |

= |

Complete nonrespondents (RESP=“NR”) |

|

wgt |

= |

TAB_WGT value |

|

h |

= |

Adjustment cell (SECTOR x EMPSIZE_COLLAPSE) |

|

NAFh |

= |

Nonresponse adjust factor for cell h |

Tabulation

Although as many firms as possible were identified as out of scope during sampling, additional out-of-scope firms were identified with response or updated administrative data not available at the time of sampling. These firms were removed for tabulations and include the following:

- Firms with zero employment based on response or 2017 administrative data

- Firms that responded as out of business before 2017

- Nonprofit firms

- Firms that responded as being owned by a domestic parent company

Industry Classification

The industry classifications of firms are based on the 2017 NAICS. Firms with more than one domestic establishment are assigned a single industry classification using a hierarchal system based on the largest payroll sector, largest payroll three-digit NAICS (within the largest sector), largest payroll four-digit NAICS (within the largest three digit), and largest payroll six-digit NAICS (within the largest four digit). For tabulation, industry classification was based on administrative data for 2017.

Geography. Firms with establishments operating in more than one state are tabulated as unclassified and counted only once in state and national totals.

Variance estimation. The particular sample used for this survey is one of a large number of all possible samples of the same size that could have been selected using the same sample design. Estimates derived from the different samples would differ from each other. The relative standard error and standard error are measures of the variability among the estimates from all possible samples. The estimated relative standard errors and estimated standard errors presented in the tables estimate the sampling variability, and thus measure the precision with which an estimate from the particular sample selected for this survey approximates the average result of all possible samples. Relative standard errors and standard errors are applicable only to those published cells in which sample cases are tabulated. A relative standard error is an expression of the standard error as a percentage of the quantity being estimated.

The ABS uses the delete-a-group jackknife variance estimator. Note that certainty cases do not contribute to the sampling variance. The delete-a-group jackknife variance estimator requires that every sampling stratum contain at least two sampled firms. Sampling strata that do not meet this requirement are collapsed as needed to create a new set of variance estimation strata that satisfies this requirement.

The sample estimate and an estimate of its relative standard error can be used to estimate the standard error, then construct interval estimates with a prescribed level of confidence that the interval includes the average results of all samples. To illustrate, if all possible samples were surveyed under essentially the same condition, and estimates were calculated from each sample, then

- approximately 68% of the intervals from one standard error below the estimate to one standard error above the estimate would include the average value of all possible samples, and

- approximately 90% of the intervals from 1.6 standard errors below the estimate to 1.6 standard errors above the estimate would include the average value of all possible samples.

Thus, for a particular sample, one can say with specified confidence that the average of all possible samples is included in the constructed interval.

Example of a confidence interval. Suppose the estimate is 51,707 and the estimated relative standard error is 2%. The standard error is then 2% of 51,707, or 1,034. An approximate 90% confidence interval is found by first multiplying the standard error by 1.6, then adding and subtracting that result from the estimate to obtain the upper and lower bounds. Because 1.6 times 1,034 equals 1,654, the confidence interval in this example is 51,707 plus or minus 1,654 or in the range from 50,053 to 53,361.

Example of a confidence interval for percentage data. Suppose the estimate is 76.9% and the estimated standard error is 0.4%. An approximate 90% confidence interval is found by first multiplying the standard error by 1.6, then adding and subtracting that result from the estimate to obtain the upper and lower bounds. Because 1.6 times 0.4% equals 0.64%, the confidence interval in this example is 76.9% plus or minus 0.64% or in the range from 76.26% to 77.54%.

Confidentiality. In accordance with United States Code, Title 13, Section 9, no data are published that would disclose the operations of an individual establishment or business. Data obtained from the IRS, the Social Security Administration, and other sources are also treated as confidential and can be seen only by Census Bureau employees sworn to protect the data from disclosure.

Disclosure Avoidance

Disclosure avoidance is the process used to protect the confidentiality of the survey data provided by an individual or firm. Using disclosure avoidance procedures, the Census Bureau modifies or removes the characteristics that may disclose confidential information. Although it may appear that a table shows information about a specific individual or business, the Census Bureau has taken steps to mask or suppress the original data while making sure the results are still useful. Census Bureau reviewed the detailed statistical tables for unauthorized disclosure of confidential information and has approved the disclosure avoidance practices applied (Approval ID: CBDRB-FY20-008).

Noise infusion. The ABS uses noise infusion as the primary method of disclosure avoidance. Noise infusion perturbs data values prior to tabulation by applying a random noise multiplier to the magnitude data, such as the sales and receipts for all firms. Disclosure protection is accomplished in a manner that causes the vast majority of cell values to be perturbed by, at most, a few percentage points. For the ABS, the estimated relative standard error for a published cell includes the estimated sampling error and the amount of perturbation in the estimated cell value due to noise.

Individual cells may be suppressed because of data quality standards. Suppressed data cells are replaced with an S.

Survey Quality Measures

The estimates produced from the ABS are subject to sampling and nonsampling errors.

Sampling error. The sampling error is described earlier in the section “Variance estimation.” Detailed relative standard errors are available upon request.

Coverage error. Coverage error could result from companies with high employment providing R&D or companies with low employment failing to provide R&D. The companies were asked to provide their employment, which serves as a check on the employment coverage.

Nonsampling error. All surveys and censuses have nonsampling errors. Nonsampling errors are attributable to various sources, such as the inability to obtain information for all cases in the universe, imputation for missing data, data errors and biases, mistakes in recording or keying data, errors in collection or processing, and coverage problems.

Although explicit measures of the effects of these nonsampling errors are not available, adjustments are made to the published relative standard errors to account for errors associated with imputation of missing data. It is believed that most of the important operational and data errors were detected and corrected through an automated data edit designed to review the data for reasonableness and consistency. Quality control techniques were used to verify that operating procedures were carried out as specified.

Measurement error. The most common source of measurement error was reporting in different units (e.g., reporting whole dollars rather than thousands of dollars).

Data Comparability

This is the first year of data collection for the ABS. The information may not be fully comparable with information from previous surveys.

Definitions

Domestic or United States. Refers to a location in any of the U.S. 50 states and the District of Columbia.

Employment. Paid employment consists of full- and part-time employees, including salaried officers and executives of corporations, who were on the payroll in the pay period including March 12. Included are employees on sick leave, holidays, and vacations; not included are proprietors and partners of unincorporated businesses.

Ethnicity. Based on the OMB’s guidance, there are two minimum categories for ethnicity: Hispanic or Latino and Not Hispanic or Latino. OMB considers race and Hispanic origin to be two separate and distinct concepts. Hispanics and Latinos may be of any race.

Firm. A business organization or entity consisting of one or more domestic establishment locations under common ownership or control.

Foreign parent (of a U.S.-located business). The first entity outside the United States in an affiliate’s ownership chain that has a direct or indirect investment interest of more than 50% of the affiliate’s voting securities.

Innovation. An innovation is the introduction of a new or significantly improved product, process, organizational method, or marketing method by this business. An innovation must have characteristics or intended uses that are new or that provide a significant improvement over what was previously used or sold by the business. However, an innovation can fail or take time to prove itself. An innovation need only be new or significantly improved for the business. It could have been originally developed or used by other businesses or organizations. The four types of innovation are product innovation, process innovation, marketing innovation, and organizational innovation.

Intellectual property. Includes patents, processes, and trade secrets; books and music; trademarks; recorded performances and events such as radio and television programs and motion pictures; broadcast and recorded live performances and events and their content; general-use computer software; franchise fees; and other (e.g., digital media).

Noise infusion. A method of disclosure avoidance in which values are perturbed prior to tabulation by applying a random noise multiplier to the magnitude data, such as the sales and receipts for all firms. Disclosure protection is accomplished in a manner that causes the vast majority of cell values to be perturbed by, at most, a few percentage points.

North American Industry Classification System (NAICS). NAICS is the standard used by federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing, and publishing statistical data related to the U.S. business economy. This system is used by the United States, Canada, and Mexico.

Race. The data on race were derived from answers to the race question. Race data are collected in accordance with the guidelines provided by OMB, and these data are based on self-identification. The racial categories included in the questionnaire generally reflect a social definition of race recognized in this country and not an attempt to define race biologically, anthropologically, or genetically. In addition, it is recognized that the categories of the race question include race and national origin or sociocultural groups. OMB requires that race data be collected for a minimum of five groups: White, Black or African American, American Indian or Alaska Native, Asian, and Native Hawaiian or Other Pacific Islander. Respondents may report more than one race.

Receipts. Includes the total sales, shipments, receipts, revenue, or grants for domestic operations, excluding foreign subsidiaries.

Research and development (R&D). R&D is planned, creative work aimed at discovering new knowledge or devising new applications of available knowledge. This includes (1) activities aimed at acquiring new knowledge or understanding without specific immediate commercial applications or uses (basic research), (2) activities aimed at solving a specific problem or meeting a specific commercial objective (applied research), and (3) systematic use of research and practical experience and resulting in additional knowledge, which is directed to producing new or improved goods, services, or processes (development). R&D includes direct costs, such as salaries of researchers, and administrative and overhead costs clearly associated with the company’s R&D. However, R&D does not include expenditures for routine product testing, quality control, and technical services unless they are an integral part of an R&D project. R&D also does not include market research; efficiency surveys or management studies; literary, artistic, or historical projects, such as films, music, or books and other publications; and prospecting or exploration for natural resources.

- Basic research. Activities aimed at acquiring new knowledge or understanding without specific immediate commercial applications or uses.

- Applied research. Activities aimed at solving a specific problem or meeting a specific commercial objective.

- Development. Systematic work, drawing on research and practical experience and resulting in additional knowledge, which is directed to producing new products or processes or to improving existing products or processes.

Sex. For the purposes of the ABS, sex refers to a person’s biological sex. The sex question wording very specifically intends to capture a person’s biological sex and not gender.

Worldwide sales. Worldwide and domestic sales and operating revenues, including grants.

Technical Tables

Acknowledgments and Suggested Citation

Acknowledgments

Audrey Kindlon of the National Center for Science and Engineering Statistics (NCSES) developed and coordinated this report under the guidance of John Jankowski, NCSES Program Director, and leadership of Emilda B. Rivers, NCSES Director; Vipin Arora, NCSES Deputy Director; and Samson Adeshiyan, former NCSES Chief Statistician. Jock Black (NCSES) reviewed the report.

The U.S. Census Bureau, under National Science Foundation interagency agreement number NCSE-1748418, collected and tabulated the data and produced the statistics for this report. This work was performed by the Economic Reimbursable Surveys Division under the direction of Kevin Deardorff, Division Chief, and Aneta Erdie, Assistant Division Chief. This work was performed under the supervision of Patrice Hall, assisted by Naomi Blackman, John Clark, and Gail White with staff assistance from Ahmad Bakhshi, Elaine Emanuel, Mary Frauenfelder, Adji Fatou Diagne, Aaron Finkle, Samantha Hernandez, James Jarzabkowski, Jessica Welch, and Tesfay Weldu. Additional support, including table creation and subject matter expertise was provided by Brandon Shackelford. Mathematical and statistical techniques were provided by the Economic Statistical Methods Division under the direction of Carol Caldwell, Division Chief, and Xijian Liu, Assistant Division Chief. This work was performed under the supervision of James Hunt, assisted by Roberta Kurec with staff support from Taylor Beebe, Alexandra Abzun Cadenas, Charles Champion, and Daniel Cordes.

Data collection procedures and operations were provided by the Economic Management Division under the direction of Lisa Donaldson, Division Chief, and Michelle Karlsson, Assistant Division Chief. The staff of the National Processing Center performed mailout preparation, respondent assistance, and correspondence processing. Project management support was provided by Laura Hardesty and Alicia Kelley. Development and coordination of the computer processing system was provided by the Economic Application Division under the direction of Samuel Jones, Division Chief, and Christopher Rill, Assistant Division Chief. This work was performed by Marilyn Balogh, Anthony Caruso, Michael Feldman, David Kahwajy, David Gonzalez, Joseph Talbot, and Diana Viton. RTI International provided editing services. Publication processing support was provided by Catherine Corlies and Tanya Gore (NCSES).

Suggested Citation

National Center for Science and Engineering Statistics (NCSES). 2020. Annual Business Survey: Data Year 2017. NSF 21-303. Alexandria, VA: National Science Foundation. Available at https://ncses.nsf.gov/pubs/nsf21303/.

Contact Us

NCSES

National Center for Science and Engineering Statistics

Directorate for Social, Behavioral and Economic Sciences

National Science Foundation

2415 Eisenhower Avenue, Suite W14200

Alexandria, VA 22314

Tel: (703) 292-8780

FIRS: (800) 877-8339

TDD: (800) 281-8749

E-mail: ncsesweb@nsf.gov

An official website of the United States government

An official website of the United States government